nd sales tax permit

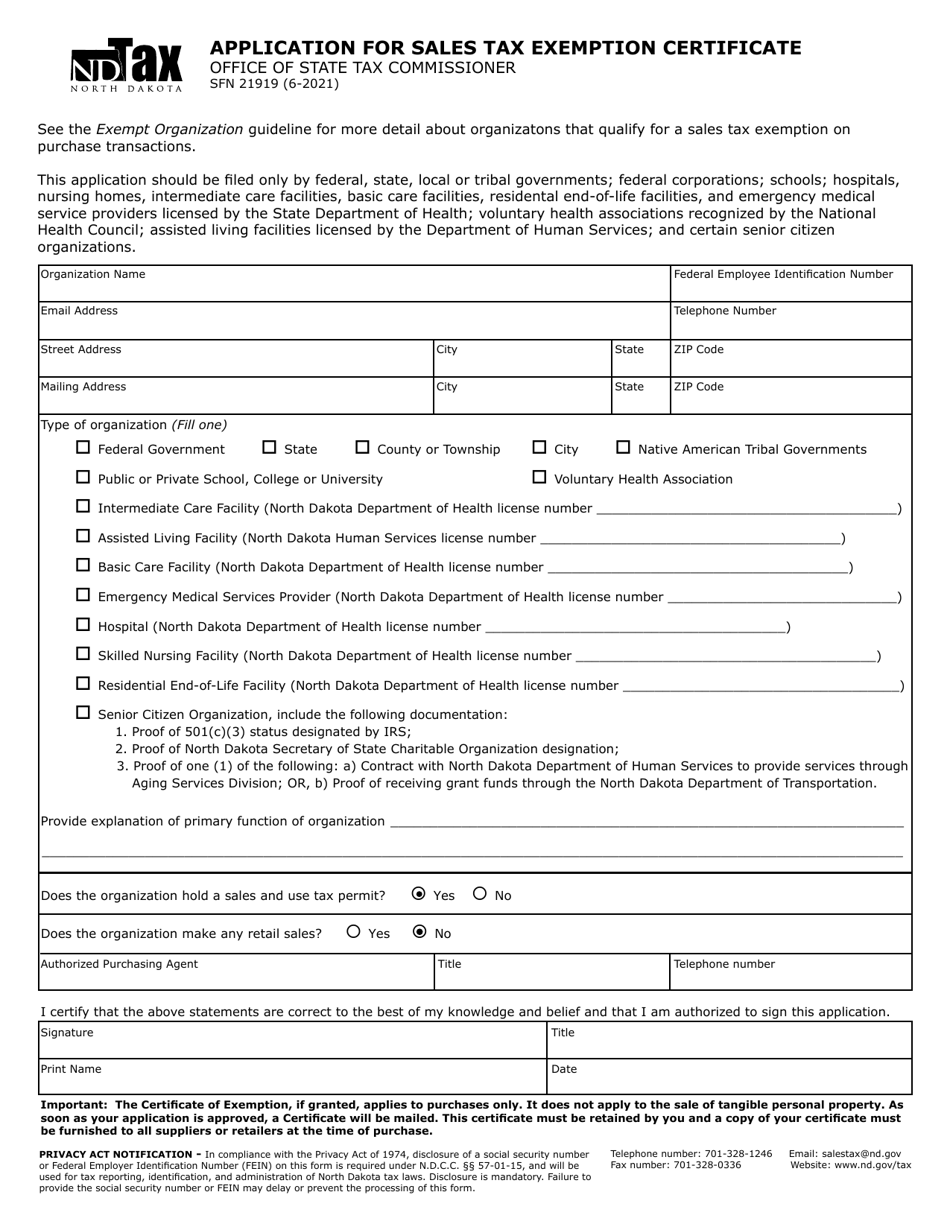

To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail. Obtain a North Dakota Sales Tax Permit.

State Corporate Income Tax Rates And Brackets Tax Foundation

North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders.

. There are two ways to register for a sales tax permit in North Dakota either by paper application or via the online website. Manage your North Dakota business tax accounts with Taxpayer Access point TAP. North Dakota Tax Dept.

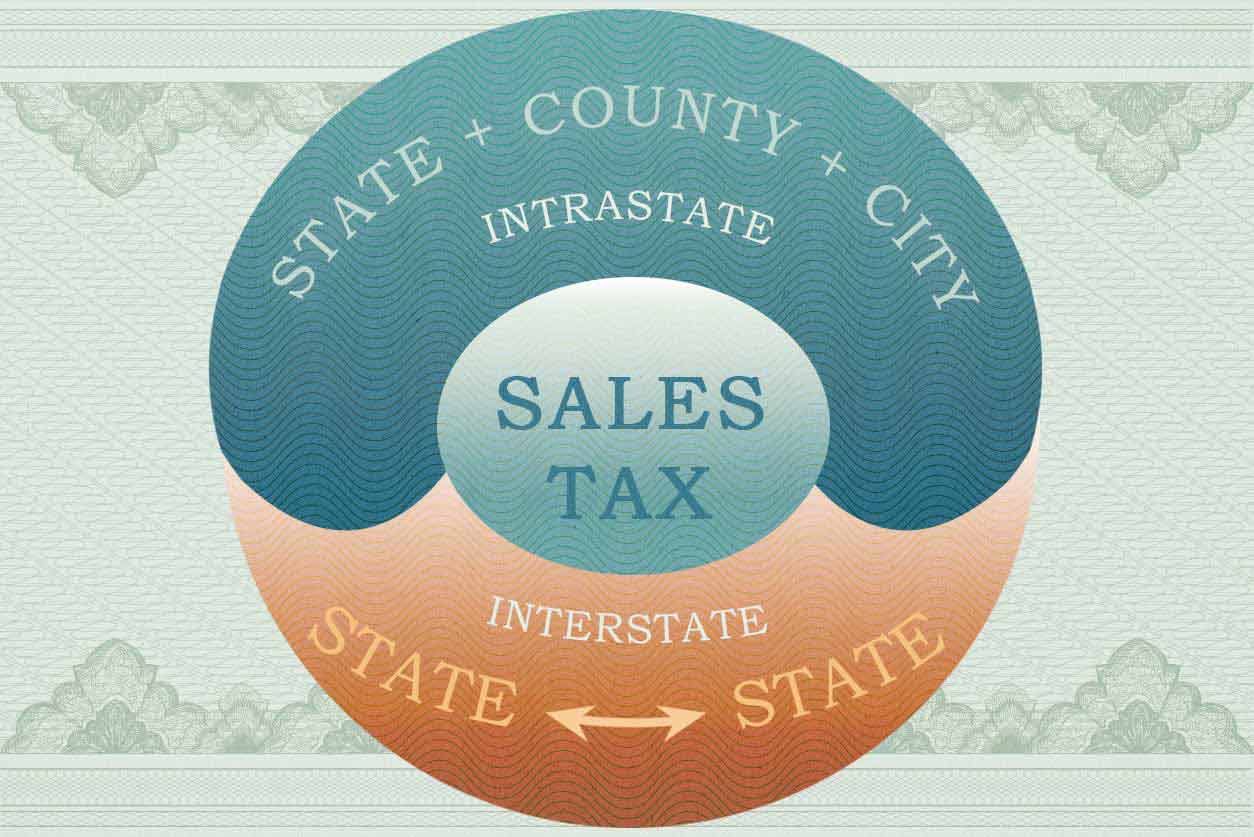

The sales tax rate for Bismarck North Dakota when combined with State and County taxes is 7 percent. To search for a specific guideline use the search boxes to enter the name of the guideline select the tax type or include the guidelines. Step 2 Enter the purchasers State of origin and State and Use Tax Permit number.

North Dakota Tax Dept. View to earn more about combined state and city rates within the city limits. Get Your North Dakota Sales.

TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view. OFFICE OF STATE TAX COMMISSIONER CERTIFICATE OF RESALE SFN 21950 11-2002 I hereby certify that I hold _____ Sales and Use Tax permit number_____. Wednesday September 14 2022 - 0900 am.

Where to Register for a North Dakota Sales Tax Permit. A mobile home tax permit will be issued to the owner of the mobile home when the tax and any penalties have been paid in full to the county treasurer. A North Dakota Sales Tax Permit can only be obtained through an.

A sales tax permit will not be issued to a person not engaged in a retail business for the purpose of permitting that person to purchase at wholesale or to purchase. I am engaged in the business. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the second quarter of.

Therefore you can complete the ND resale certificate form by providing your ND Sales Tax Number. Register for a North Dakota Sales Tax Permit Online by filling out and submitting the State Sales Tax Registration form. Step 1 Begin by downloading the North Dakota Certificate of Resale Form SFN 21950.

Guidelines are listed below by tax type. The sales tax rate for Bismarck North Dakota when combined with State and County taxes is 7 percent. LicenseSuite is the fastest and easiest way to get your North Dakota sales tax permit.

Obtaining your sales tax certificate allows you to do so. You can easily acquire your North Dakota Sales. Registered users will be able to file and.

Please note that the sample list below is for illustration purposes only and may contain licenses that are. Also resale ID reseller ID sales tax ID reseller license. Or file by mail using the North Dakota Application.

In North Dakota this sellers permit lets your business buy goods or materials rent property and sell products or services tax free. We recommend submitting the application via the online. Fill out the North Dakota.

A ND sellers permit is also called a state ID a sales tax number and a general ND state resale tax numbrer for business. This permit will furnish your business with a unique sales tax number. The letter should include.

A sales tax permit can be obtained by registering online with the North Dakota Taxpayer Access Point TAP or by mailing in the Sales and Use Tax Permit Application Form. Use Tax Permit online using the Taxpayer Access Point TAP website. Use Tax Permit Online.

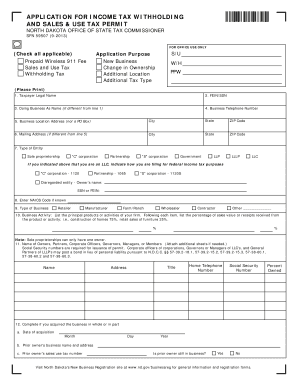

Typically it is a combination form for Income Tax Withholding and SalesUse Tax Permit Application. A current mobile home tax permit is. The taxpayer must receive an air quality permit or a notice that the air quality permit application is complete from the North Dakota Department of Environmental Quality by June 30 2023.

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Craft Fairs And Sales Tax A State By State Guide

Online Sales Tax Tips For Ecommerce 2022

Sales Tax For Small Businesses Truic

How To Get A North Dakota Sales Amp Use Tax Permit North Dakota Sales Tax Handbook

Form 21919 Application For Sales Tax Exemption Certificate

How To Register For A Sales Tax Permit In North Dakota Taxjar

Sales Use Tax South Dakota Department Of Revenue

Amazon Sales Tax Guide For Online Sellers In 2022

Fillable Online Nd Application For Income Tax Withholding And Sales Use Tax Permit Application For Income Tax Withholding And Sales Use Tax Permit Fax Email Print Pdffiller

How To Apply For Business Licenses And Permits In North Dakota Zenbusiness Inc

Resources For Applying For A Sales Tax Permit By State

Register For A Mississippi Sales Tax Permit Northwest Registered Agent

How To Register For A Sales Tax Permit In North Dakota Taxvalet

Us Resale Certificate Lookup Ascdi

North Dakota Sales Tax Application Registration

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller